Mastering Forex Trading with MT5: A Comprehensive Guide

Forex trading has become exceedingly popular over the years, providing traders with the opportunity to capitalize on currency fluctuations. One of the leading platforms for forex trading is MetaTrader 5 (MT5), renowned for its advanced features and robust capabilities. In this guide, we will explore the essentials of forex trading using MT5 and offer insights on how to start your trading journey. For reliable trading resources and tools, visit forex trading mt5 Trading Platform NG.

Understanding Forex Trading

Forex, or foreign exchange, involves the buying and selling of currency pairs. The aim is simple: to buy low and sell high, making a profit on the price difference. The forex market operates 24 hours a day, five days a week, and is the largest financial market in the world, with a staggering daily trading volume exceeding $6 trillion.

What is MetaTrader 5 (MT5)?

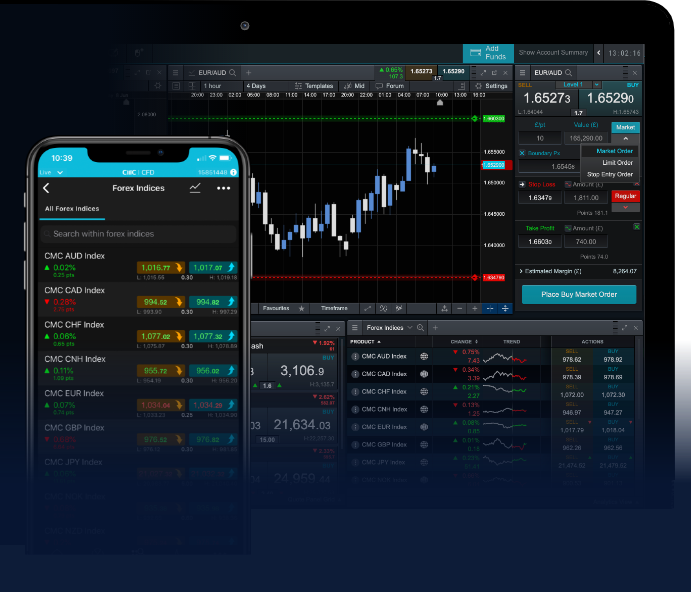

MT5, developed by MetaQuotes Software, is the successor to MetaTrader 4 (MT4) and offers enhanced functionality for traders. While both platforms are widely used, MT5 includes additional features such as more timeframes, more technical indicators, and an economic calendar, making it a more comprehensive trading tool.

Key Features of MT5

- Multi-Asset Support: MT5 allows traders to access various financial markets beyond forex, including stocks, commodities, and cryptocurrencies.

- Improved Charting Tools: With multiple chart types and timeframes, MT5 provides traders with better visual analysis options.

- Advanced Order Types: MT5 supports additional order types, giving traders more flexibility in executing their strategies.

- Algorithmic Trading: MT5 allows for the use of automated trading strategies, enabling traders to profit even when they are not actively monitoring the markets.

- Community Market: Users can purchase indicators, scripts, and trading robots from the MetaTrader marketplace.

Getting Started with MT5

To start trading on MT5, follow these steps:

- Download and Install MT5: Visit the official MetaTrader website or your broker’s site to download the MT5 platform. The installation process is straightforward and user-friendly.

- Create a Trading Account: Sign up with a forex broker that supports MT5. Ensure the broker is regulated and offers favorable trading conditions.

- Fund Your Account: Once your account is set up, deposit funds to begin trading. Make sure to understand the broker’s deposit methods and any potential fees.

- Customize Your Interface: Familiarize yourself with the MT5 interface. Customize charts, add indicators, and set up your workspace according to your preferences.

- Learn the Basics: Before diving into trading, educate yourself about market analysis, chart reading, and risk management strategies.

Strategies for Trading Forex on MT5

Successful forex trading requires a solid strategy. Here are a few popular strategies to consider when using MT5:

1. Scalping

This strategy involves making multiple trades throughout the day, aiming to profit from small price changes. Scalpers use technical analysis and indicators on the MT5 platform to identify entry and exit points quickly.

2. Day Trading

Day traders buy and sell currency pairs within the same trading day. This strategy requires a good understanding of market movements and a keen eye on news events that may affect prices.

3. Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days or weeks. Swing traders use MT5’s advanced charting capabilities to identify trends and reversals.

4. Position Trading

Position traders take a long-term approach, holding trades for weeks or months. They rely on fundamental analysis, economic indicators, and long-term market trends.

Risk Management in Forex Trading

Risk management is crucial for survival in the forex market. Here are some key risk management techniques to implement using MT5:

- Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. MT5 allows you to set your stop-loss level effectively.

- Position Sizing: Determine the appropriate size for each trade based on your risk tolerance and account balance. Avoid overleverage.

- Diversification: Spread your trades across different currency pairs and asset classes to minimize risk exposure.

- Review Your Trades: Regularly analyze your trades to identify what works and what doesn’t. MT5’s history log can help you track and evaluate your performance.

Conclusion

Forex trading using the MT5 platform opens up a world of opportunities for both novice and experienced traders. With its advanced features, comprehensive tools, and active community, MT5 is well-equipped to support your trading endeavors. By leveraging effective strategies and practicing sound risk management, you can enhance your chances of success in the dynamic forex market. Always remember, trading involves risks, and no strategy guarantees profits. Continuous learning and adapting to market changes are vital for long-term success.