Latest Forex Trading News Today: Market Insights and Updates

Today’s forex trading news today Trading Broker UAE forex news highlights significant trends and data affecting currency pairs in the global market. As traders around the world seek the best opportunities based on current economic indicators, these developments provide essential insights for making informed trading decisions.

Overview of Forex Market Conditions

The forex market experienced some volatility today, driven by various economic announcements and geopolitical tensions. With central banks around the world adjusting their monetary policies in response to inflationary pressures, traders are keenly monitoring the impact on currency valuations. Key data releases, including employment figures and inflation rates, shape market sentiment, influencing investor behavior.

Major Currency Pairs Analysis

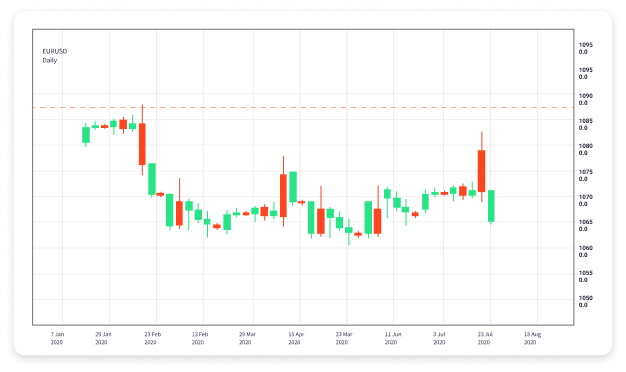

This morning’s trading session saw significant shifts in major currency pairs. The EUR/USD pair showed a rebound after falling to support levels earlier in the week. Analysts attribute this movement to a combination of U.S. economic data and developments in European markets. The GBP/USD pair, on the other hand, is under pressure as ongoing political uncertainty in the UK continues to affect the pound.

EUR/USD Dynamics

The EUR/USD has seen fluctuations amid mixed economic signals from Europe and the U.S. The Eurozone reported better-than-expected manufacturing data, which supported the Euro against the dollar. However, investors are closely watching the Federal Reserve’s stance on interest rates, particularly after recent hints at potential rate hikes. Technical analysts are looking at resistance levels around 1.1250, while support remains firm at 1.1100.

GBP/USD: Political Factors at Play

The British pound’s performance has been heavily influenced by the political landscape in the UK. Recent developments concerning Brexit negotiations and changes in government policy have created uncertainty, which is reflected in the currency’s volatility. Traders are advised to stay updated on parliamentary discussions, as any significant announcements could lead to immediate reactions in the markets.

Commodity Currencies: AUD and NZD Focus

Commodity currencies such as the Australian Dollar and New Zealand Dollar are reacting to fluctuations in commodity prices and global demand. Today, both currencies gained against the U.S. dollar, largely due to rising commodity prices and favorable trade conditions. The Australian economic outlook remains optimistic, especially as trade relationships in Asia continue to strengthen.

Australian Dollar (AUD)

The Australian Dollar has been stable, driven by increased demand for iron ore and coal. As the Chinese economy rebounds, expectations for continued growth support the upward movement of the AUD. Analysts suggest that an upcoming meeting between Australia and China may further solidify trade relations, potentially pushing the AUD higher.

New Zealand Dollar (NZD)

The NZD is benefiting from strong agricultural exports and positive dairy prices. Traders are watching the upcoming Reserve Bank of New Zealand (RBNZ) meeting, where any signals regarding interest rates will be pivotal in determining the future direction of the NZD. Market sentiment remains cautiously optimistic, provided the global demand for dairy remains robust.

Geopolitical Influences on Forex Trading

Geopolitical tensions continue to be a predominant theme affecting forex trading. Events such as trade wars, diplomatic relations between powerful nations, and regional conflicts can lead to risk aversion among investors. This often results in the strengthening of safe-haven currencies like the Swiss Franc and Japanese Yen.

Safe Havens: CHF and JPY Performance

Amidst rising global tensions, the Swiss Franc and Japanese Yen have gained traction. Investors are turning to these currencies as a hedge against potential market downturns. Economic reports today suggest that both currencies may continue to see increased demand if geopolitical uncertainties persist.

Economic Indicators to Watch

Traders should keep an eye on the upcoming economic indicators that may affect the forex market this week. Non-farm payroll data, inflation rates, and central bank meetings are scheduled, which could lead to increased volatility. Understanding how these indicators impact currency values is crucial for successful trading strategies.

Upcoming Economic Releases

- U.S. Non-Farm Payrolls Report – Friday

- Eurozone Inflation Rate – Thursday

- Bank of England Interest Rate Decision – Next Week

Conclusion

In conclusion, today’s forex trading news highlights several key market dynamics that traders should consider when making decisions. By staying informed about economic indicators, geopolitical shifts, and technical analysis, investors can navigate the complexities of the forex market more effectively. Overall, the unpredictability of the market means that continuous education and adaptability are vital in pursuing trading success.