Essential Guide to Forex Trading: A Course for Beginners

If you are looking to dive into the world of forex trading, you have made a wise decision. The foreign exchange market is one of the largest financial markets globally, offering substantial opportunities for traders. Knowing where to begin is crucial in this complex environment. In this guide, we will walk you through the essential components of a comprehensive forex trading course for beginners Cameroonian Trading Platforms course designed for beginners. By the end of this article, you will be equipped with fundamental knowledge and resources to start trading effectively.

Understanding Forex Trading

Forex trading involves buying one currency while simultaneously selling another. The market operates 24 hours a day, five days a week, providing ample opportunities to enter trades across different time zones. Traders can benefit from price fluctuations resulting from various economic, political, and social factors. Understanding these factors is crucial for making informed trading decisions.

The Basics of Currency Pairs

In forex trading, currencies are traded in pairs. The most common pairs are known as major pairs, which include the euro/dollar (EUR/USD), dollar/yen (USD/JPY), and pound/dollar (GBP/USD). Each pair has a base currency (the first currency listed) and a quote currency (the second currency). When trading, the trader speculates whether the base currency will strengthen or weaken against the quote currency. A basic understanding of currency pairs will serve as a foundation for your trading journey.

The Importance of Learning and Education

One of the most important steps for a beginner is to invest time in learning. A forex trading course can significantly shorten the learning curve and increase your chances of success. Here are some key areas covered in most forex trading courses:

- Trading Terminology: Familiarize yourself with common terms like pips, spreads, leverage, and margin.

- Market Analysis: Learn the two main types of analysis: technical analysis (using charts and historical data) and fundamental analysis (focusing on economic indicators).

- Risk Management: Understand the risks involved in trading and how to manage your capital effectively to mitigate losses.

- Trading Strategies: Explore different trading strategies, such as day trading, swing trading, and scalping.

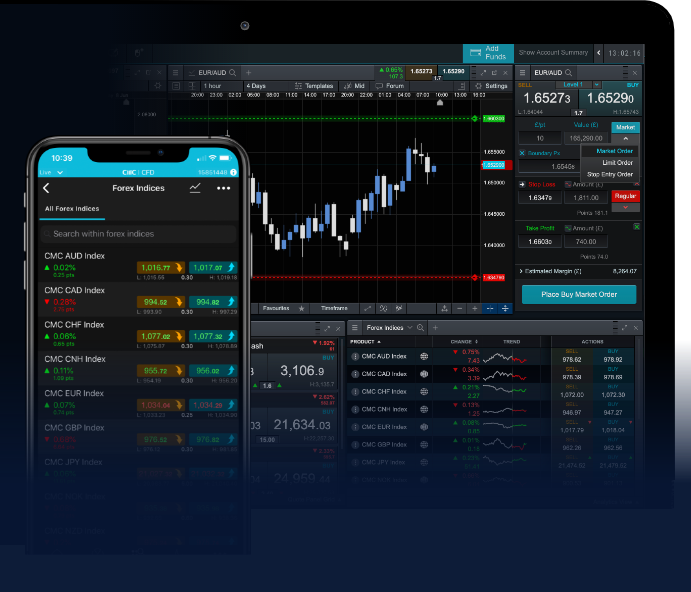

Choosing a Trading Platform

Your choice of a trading platform is critical to your trading experience. When selecting a platform, consider factors like user interface, available tools, fees, and customer support. Many platforms also offer demo accounts, allowing you to practice trading without risking real money. This is an essential component of the learning process, especially for beginners.

Risk Management in Forex Trading

Managing risk is vital in forex trading. Successful traders understand the significance of risk management strategies, which can protect your capital while maximizing potential profits. Here are some essential risk management techniques:

- Use Stop-Loss Orders: Place stop-loss orders to automatically close a trade when it reaches a specified level, limiting potential losses.

- Set a Risk-Reward Ratio: Consider the risk-reward ratio before entering a trade, ensuring potential rewards justify the risks.

- Diversify Your Portfolio: Avoid putting all your funds into one trade or currency pair; diversify to minimize risk.

Practicing with a Demo Account

Before trading with real money, utilize a demo account to practice your skills. Demo accounts simulate the trading environment, allowing you to test strategies and gain experience without financial risk. This hands-on practice is invaluable for beginners, as it helps build confidence and allows you to make mistakes without the fear of losing money. Gradually, you can transition to a live account as you become more comfortable and skilled.

Developing a Trading Plan

Creating a trading plan is essential for success in forex trading. A solid trading plan includes your trading goals, strategies, risk tolerance, and methods for analyzing the market. This document serves as a roadmap for your trading actions and helps to manage emotions during trades. Stick to your plan and adapt it based on your experiences and changing market dynamics.

Continuous Learning and Adaptation

The forex market is dynamic and continually evolving. As a trader, it is essential to stay informed about global economic news, changes in regulations, and market trends. Continuous learning is vital; consider attending webinars, reading educational books, and joining trading communities where you can share experiences and insights with others.

Common Mistakes to Avoid

As a beginner, you are likely to encounter challenges and make mistakes along the way. Here are some common pitfalls to avoid:

- Over-leveraging your trades, which can lead to significant losses.

- Trading without a plan, leading to emotional decision-making.

- Ignoring risk management principles

- Failing to adequately analyze market trends

Conclusion

Starting your forex trading journey can be both exciting and daunting. With dedication and the right education, you can navigate the complexities of this market successfully. Enrolling in a forex trading course for beginners is an excellent first step in acquiring the knowledge needed to make informed trading decisions. Focus on developing a trading plan, managing your risk, and continuing to educate yourself. Remember, trading is a marathon, not a sprint; success comes with time and experience.