How to Open a Forex Trading Account: A Step-by-Step Guide

Are you looking to delve into the world of forex trading? Opening a forex trading account is your first step towards capitalizing on the global currency markets. This guide will walk you through the necessary steps to open a trading account successfully, along with tips and considerations for choosing the right broker. If you’re based in Pakistan, check out open forex trading account Trading Brokers in Pakistan for reliable options in your region.

Understanding Forex Trading

Forex, or foreign exchange, is the largest financial market in the world, where currencies are traded. It operates 24 hours a day, five days a week, and offers fantastic opportunities for traders. However, it can also be risky without proper knowledge and preparation. Opening a forex trading account gives you access to this market and allows you to buy and sell currencies.

Step 1: Choose a Reliable Broker

The very first step in opening a forex trading account is selecting a reliable broker. A broker acts as an intermediary between you and the forex market. When choosing a broker, consider the following:

- Regulation: Ensure the broker is regulated by a reputable authority to protect your funds.

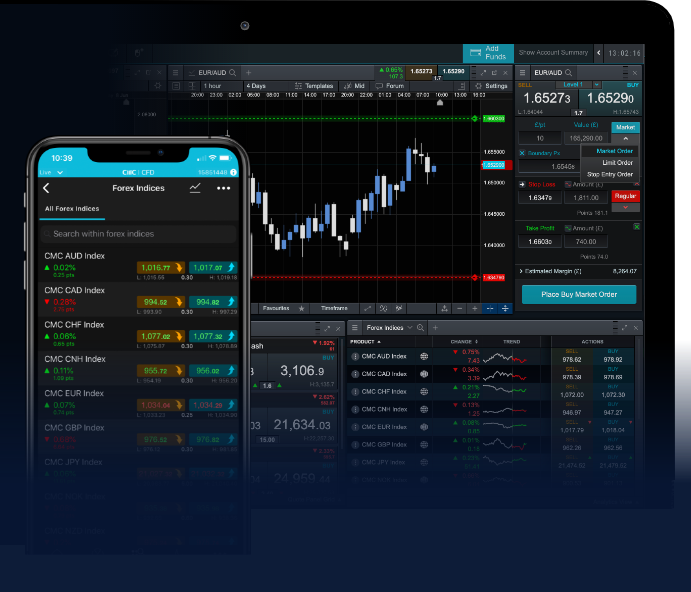

- Trading Platform: Check if the broker offers a user-friendly and stable trading platform.

- Account Types: Look for brokers that provide various account types to suit different trading styles and experience levels.

- Leverage: Understand the leverage offered by the broker, as this can amplify both gains and losses.

- Customer Support: Reliable customer support is crucial for addressing your concerns quickly.

Step 2: Sign Up for an Account

Once you have selected a broker, the next step is to register and create a trading account. This process usually involves the following:

- Application Form: Fill out an online application form with your personal details.

- Verification: Most brokers require some form of identification for verification. This often includes submitting documents like a passport, driver’s license, and a utility bill to confirm your address.

- Account Selection: Choose the type of account you wish to open, such as a demo account for practice or a live account to trade with real money.

Step 3: Fund Your Account

After your account is set up and verified, you will need to fund it. Different brokers offer various funding methods, including:

- Bank Transfer: A reliable method but may take a few days to process.

- Credit/Debit Card: Fast and easy for instant funding.

- Online Payment Systems: Platforms like PayPal, Skrill, or Neteller are also commonly accepted.

Be mindful of each method’s fees and processing times when funding your account.

Step 4: Download Trading Software

Most forex brokers provide a trading platform where you can execute trades. The popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Download the software from your broker’s website and install it on your device. Familiarize yourself with the interface and features to ensure you can navigate the platform effectively.

Step 5: Understand the Trading Environment

Forex trading involves understanding key concepts such as currency pairs, pips, spreads, and lots. It’s crucial to grasp these fundamentals before you start trading:

- Currency Pairs: Currencies are quoted in pairs, e.g., EUR/USD, indicating the value of one currency against another.

- Pips: A pip is the smallest price move that a given exchange rate can make, usually the fourth decimal point.

- Spread: The difference between the buying price (ask) and the selling price (bid) of a currency pair.

- Lots: Forex is traded in lots, which are standardized quantities of currency.

Step 6: Start Trading

Now that your account is funded and you’re familiar with the trading environment, it’s time to place your first trade. It is advisable to start with smaller trades to minimize risk as you get accustomed to the market behavior. Consider different trading strategies, and always practice risk management by setting stop-loss orders to protect your investment.

Step 7: Continuous Learning and Improvement

Forex trading is not just a one-time act but a continuous learning process. Engage in educational resources, webinars, and forums. Stay updated with market news and technical analysis to enhance your trading skills. Consider keeping a trading journal to track your trades and strategies for later review.

Final Thoughts

Opening a forex trading account is the first step toward becoming an active participant in the exciting and volatile world of currency trading. By selecting the right broker and educating yourself about the market, you can navigate the complexities of forex trading more effectively. Remember always to trade wisely, utilize proper risk management practices, and stay informed about market trends.

Your journey in forex trading has just begun, and with the right tools and knowledge, you can work towards achieving your financial goals. Happy trading!