In the ever-evolving world of forex trading, understanding various concepts is crucial for successful trading. One such vital concept is the forex spread, particularly when dealing with platforms like PrimeXBT. The primexbt forex spread PrimeXBT spot islem offers unique trading opportunities that traders need to leverage effectively. This article will delve into the intricacies of the PrimeXBT forex spread, how it affects trading strategies, and tips to enhance trading outcomes.

What is Forex Spread?

The forex spread refers to the difference between the bid price and the ask price of a currency pair. In simple terms, the bid price is the amount a trader is willing to pay for a currency, whereas the ask price is the amount at which the currency is available for sale. The spread is usually measured in pips and is an essential cost that traders must consider when executing trades.

How PrimeXBT Displays Forex Spread

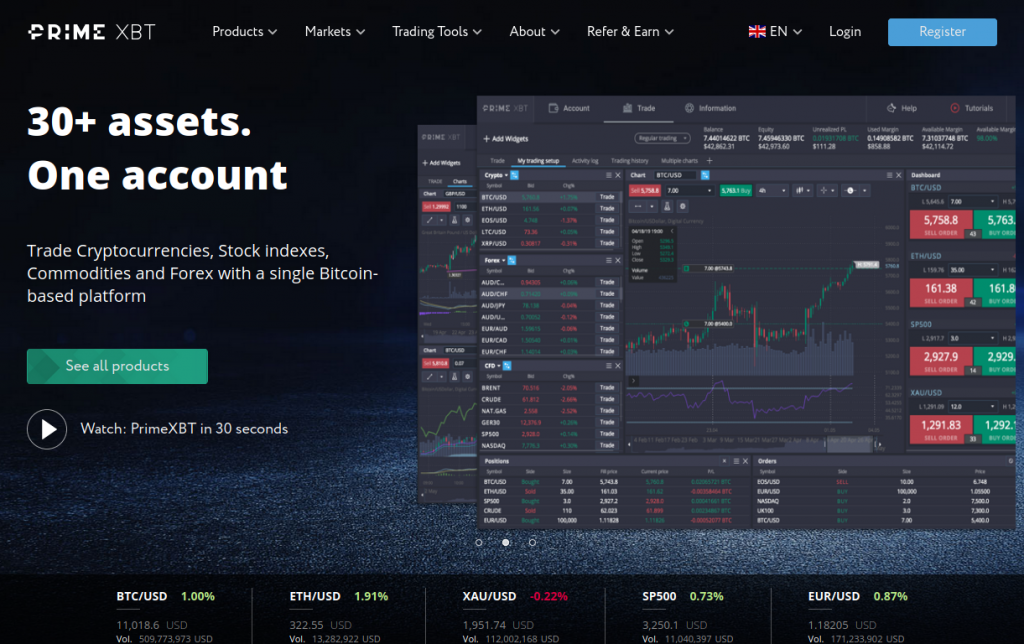

When trading on the PrimeXBT platform, users will notice that the forex spread can vary significantly based on market conditions and the specific currency pairs being traded. PrimeXBT typically offers competitive spreads, allowing traders to enter and exit positions with minimal cost. Understanding how PrimeXBT quotes the spread will help traders to assess their potential trading costs accurately.

Types of Forex Spreads

Forex spreads can be categorized into several types:

- Fixed Spread: This type remains constant regardless of market conditions. It is beneficial during stable market conditions but can be disadvantageous during volatile periods when spreads might widen.

- Variable Spread: Variable spreads fluctuate based on market volatility and liquidity. They can be narrower during stable market conditions but broaden during high volatility.

- Commission-based Spread: Some brokers, including PrimeXBT, may charge a commission on trades, offering tighter spreads in return. This approach can often lead to better overall trading efficiency.

Factors Influencing Forex Spreads

Several factors can influence the size of the forex spread on platforms like PrimeXBT:

- Market Liquidity: High liquidity often leads to tighter spreads, as there are more buyers and sellers available. Conversely, during times of low liquidity, spreads tend to widen.

- Market Volatility: Events that create significant price fluctuations (e.g., economic announcements, geopolitical events) can cause spreads to widen as brokers account for increased risk.

- Time of Day: The forex market operates 24 hours, but different trading sessions (London, New York, Tokyo) can affect liquidity and consequently the spread.

Why Understanding Forex Spreads is Crucial

Understanding forex spreads is vital for developing effective trading strategies. A tight spread can significantly enhance a trader’s profitability, especially with high-frequency trading where small price movements lead to substantial gains. Here are a few reasons why traders should pay close attention to forex spreads:

- Cost Management: The spread is a direct trading cost; thus, managing it effectively can improve overall trading performance.

- Strategy Development: Traders must consider spreads when developing their strategies, especially in scalping where quick trades rely on minimal moves.

- Risk Management: Understanding when spreads might widen (e.g., during major news releases) helps traders to manage risk more effectively.

How to Benefit from PrimeXBT Forex Spread

To maximize the advantages of trading on PrimeXBT, traders should consider the following strategies related to forex spreads:

- Choose Your Time Wisely: Identify the best times to trade specific currency pairs. Trading during peak hours can result in tighter spreads.

- Trade in High Liquidity Pairs: Major currency pairs usually offer lower spreads due to higher liquidity. Pairing your trades with high liquidity can reduce trading costs.

- Stay Informed: Monitor economic calendars and news that might affect market volatility, thus allowing you to anticipate changing spreads.

- Utilize Limit Orders: By placing limit orders, traders can potentially execute trades at more favorable prices, essentially overcoming unfavorable spreads.

Conclusion

In conclusion, understanding the PrimeXBT forex spread is an essential aspect of successful forex trading. By analyzing how spreads work and their implications on trading strategies, traders can optimize their approach for better performance and profitability. As you engage with platforms like PrimeXBT, always consider spreads in your trading decisions to achieve the best possible outcomes.